The Total Money Makeover

Learn the proven plan to break free from debt and take control of your money for good.

Guide Contents

The debt snowball method helps you pay off debt faster than you ever thought possible. Whether you’ve got student loans, credit card debt, car payments, or all of the above, you can get rid of your debt—one step at a time!

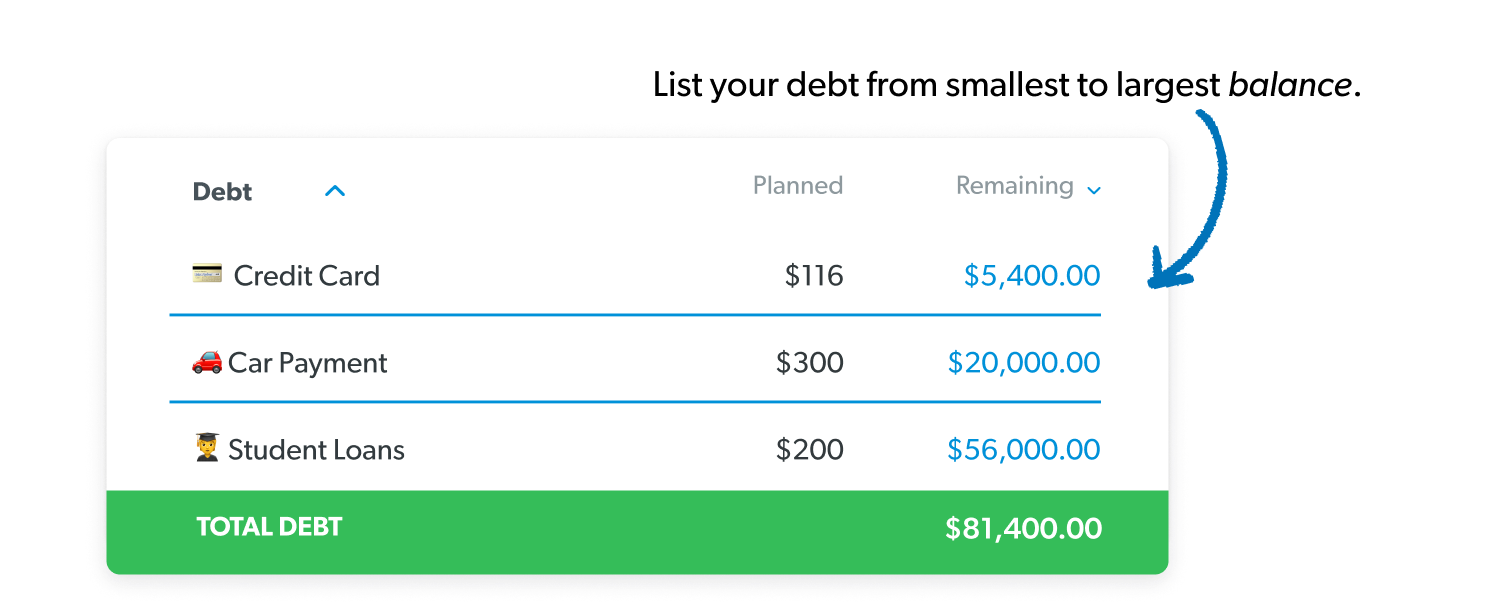

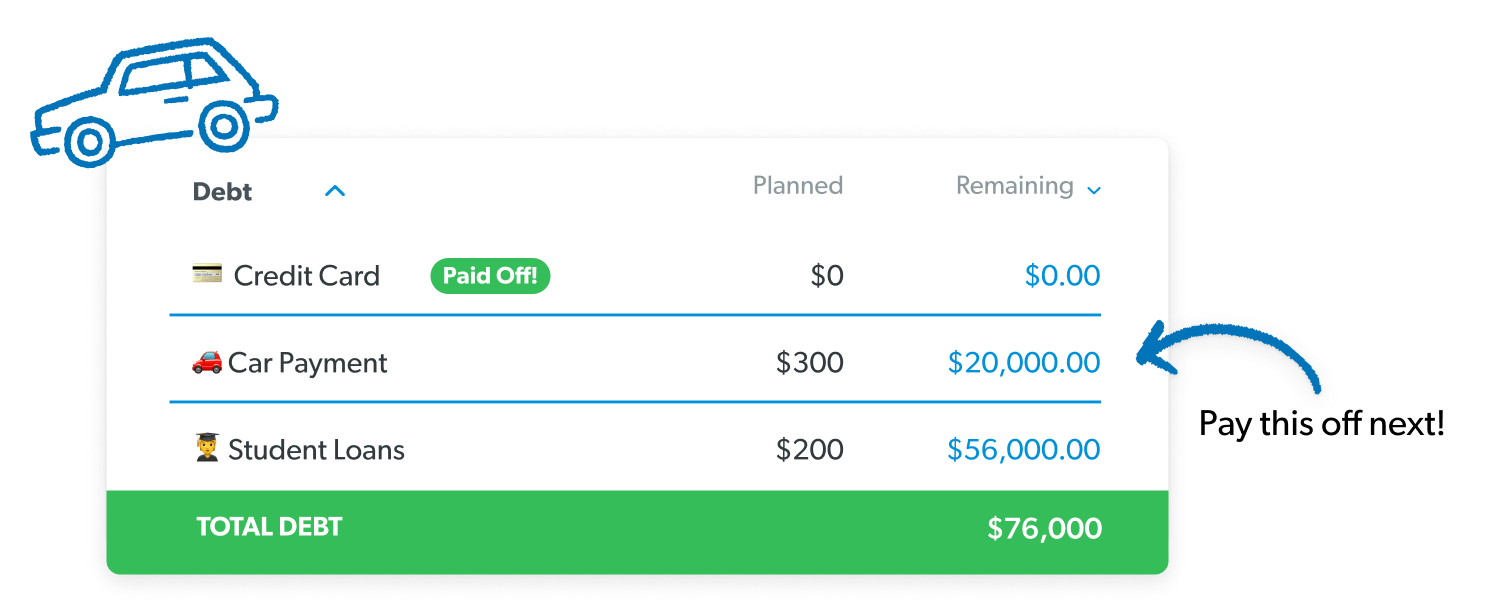

List your debts from smallest to largest (regardless of interest rate).

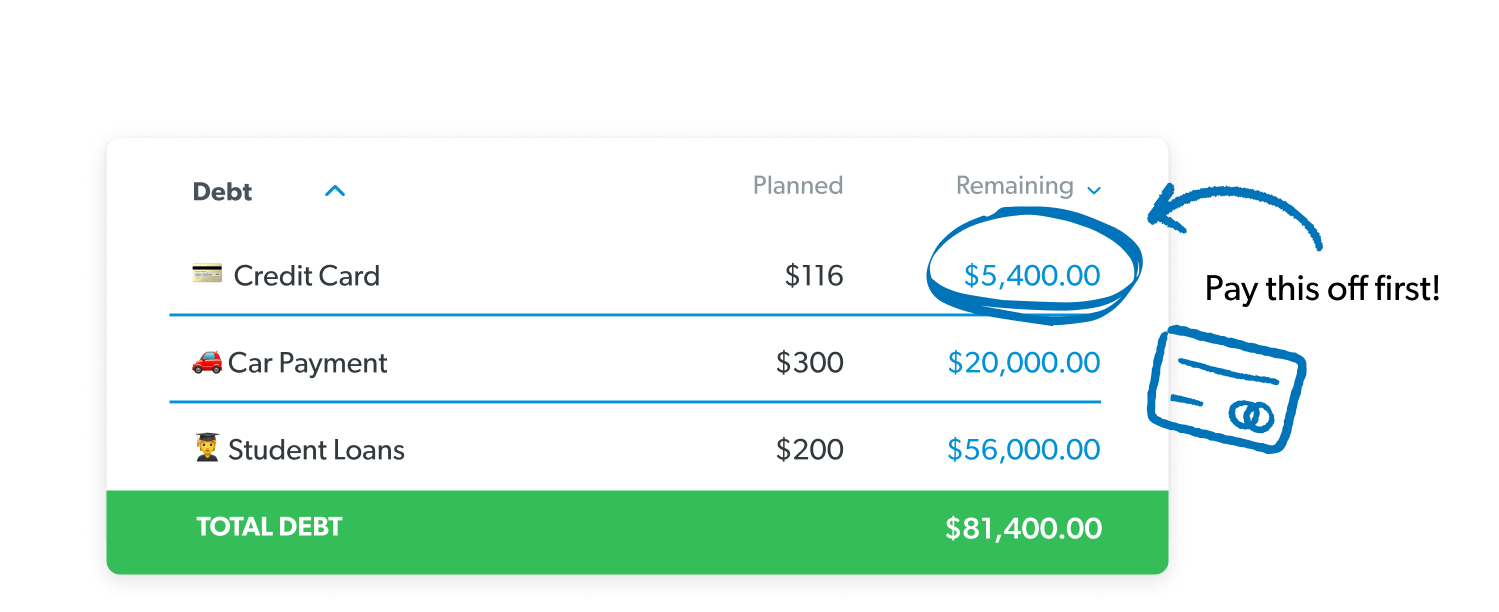

Make minimum payments on all your debts except the smallest debt.

Throw as much extra money as you can on your smallest debt until it’s gone.

Take what you were paying on your smallest debt and add that to your payment on the next-smallest debt until it’s gone too.

Repeat until each debt is paid in full and you’re completely debt-free!

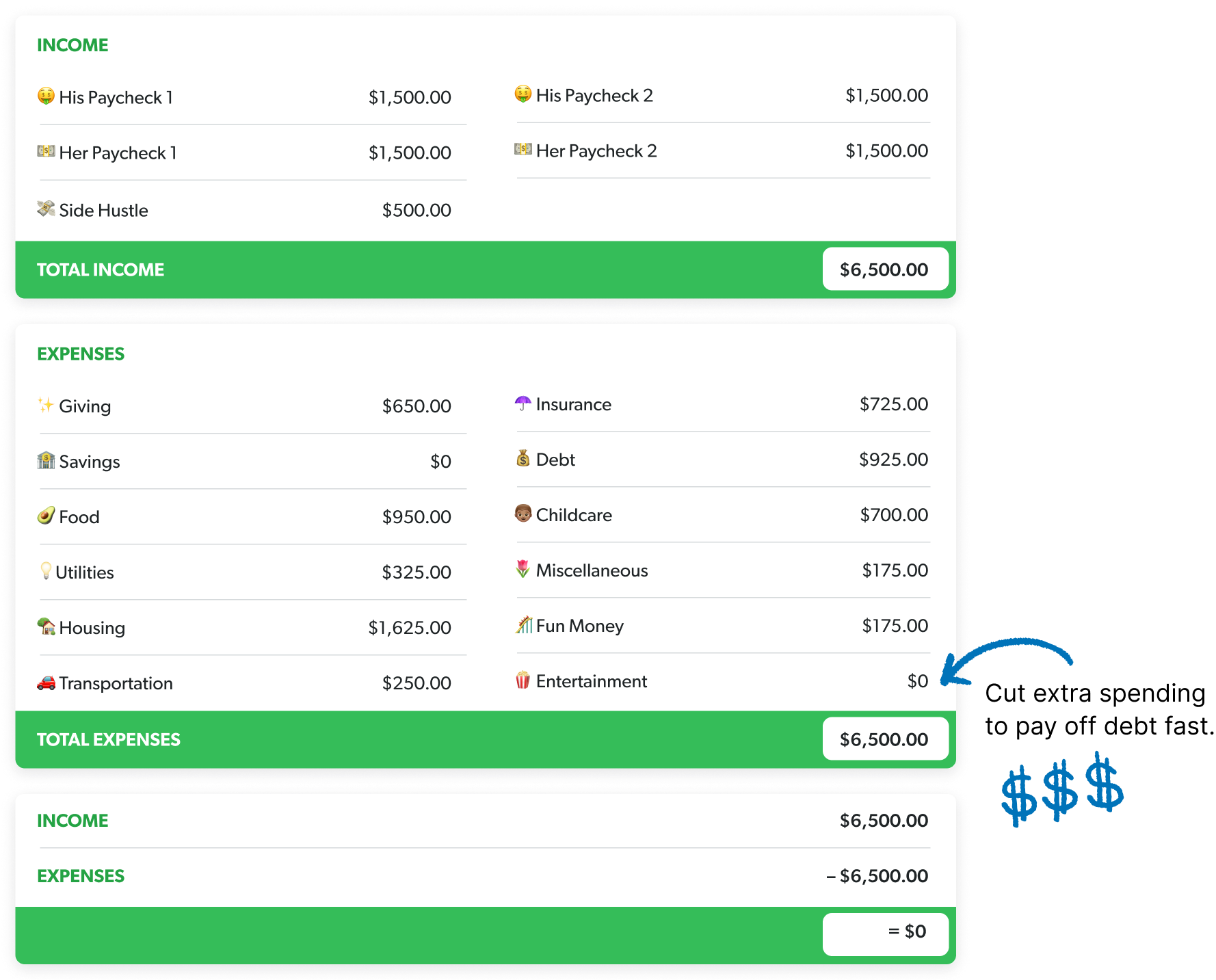

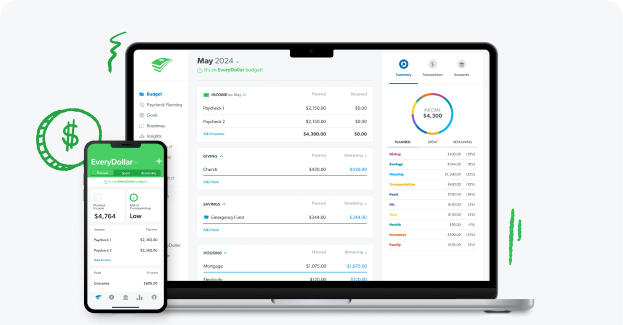

The EveryDollar budgeting app helps you cover your monthly expenses and free up more money to throw at your debt. In fact, the average person finds up to $395 in their first EveryDollar budget (now that will get things rolling!).

The debt snowball method is the best way to pay off debt—especially if you’re juggling multiple debt payments. It helps you prioritize your debts and gives you the motivation to actually make progress. Here’s how the debt snowball works:

You might be wondering if you should pay off the debt with the highest interest rate first (aka the debt avalanche method). While the math makes sense on the surface, paying off debt is about more than just the math—it’s about experiencing the motivation you need to keep going.

By paying off your smallest debt first (instead of focusing on the interest rate), you get a quick win! Plus, you immediately free up money to tackle the rest of your debt. The debt snowball gives you the motivation and momentum you need to become debt-free once and for all!

Be sure to list all your debts in your budget to keep track of your monthly payments. Adding your debts in your budget also helps you with the next step . . .

Where exactly are you supposed to find extra money to pay off debt? Great question! This is where your budget becomes your best tool. By creating more margin—cutting unnecessary expenses, adjusting spending habits, and increasing your income—you can free up cash to make real progress.

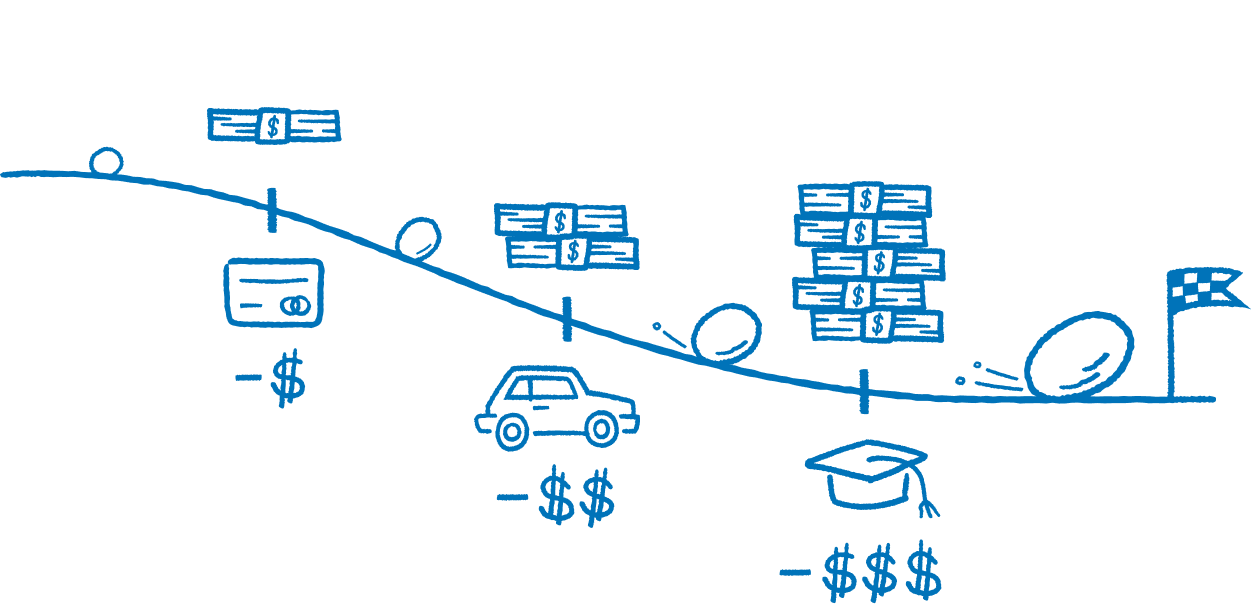

Like a snowball rolling down a hill, the amount you’re paying on your debt grows in size and gains momentum with every debt you pay off.

People who use the debt snowball method have a greater likelihood of paying off all their debt because they experience small wins early and often, which keeps them going till the end!

It usually only takes people between 18–24 months to pay off all their debt with the debt snowball. Two years? That’s a drop in the bucket! A couple years of intensity for decades of freedom? Worth it!

Plug your numbers into our Debt Snowball Calculator below to find out when you'll be debt-free. (And don’t get discouraged—this is just the first step. We’ll show you how to pay off your debt faster!)

If you continue making only minimum

payments, you'll be debt-free

Keep track of your progress! 💰

Learn the proven plan to break free from debt and take control of your money for good.

Get the support you need to finally make progress. Join the class that’s helped millions of people become debt-free.

Make a plan for your money, stop overspending, and uncover extra cash to throw at your debt.

Let’s be real: There are times when you may need to pause your debt snowball to deal with an unexpected—or expensive—situation. Here are the most common reasons to (temporarily) pause your debt snowball:

And hey, it’s okay if you do need to hit pause on your debt payoff to get through a hard season. Just be sure to get right back at it once you’re back on track with money and life.

When you’re drowning in debt, it's easy to fall for scams that promise quick fixes but only make things worse. Watch out for these common debt relief scams that can derail your progress:

Debt Consolidation

Debt consolidation is a type of loan that rolls several unsecured debts into one single bill, usually to get a lower interest rate. The intent is to help you slash mounds of debt. But really, you end up staying in debt longer because the term of your loan is extended. The longer it takes you to pay off your loan, the more money you pay in interest. That’s why we call it debt CON-solidation. (The only version of this we might suggest is student loan consolidation.)

Debt Settlement

Debt settlement means you hire a company to negotiate a lump-sum payment with your creditors for less than what you owe. Debt settlement companies also charge a fee for their “service.” Most of the time, settlement fees cost between $1,500 to $3,500, which is way more than you would pay if you cut out the middleman and settled the debts yourself.

Withdrawing or Borrowing From Retirement Savings

You might be tempted to withdraw money from your retirement to pay off your debt, especially if you’re having trouble making payments. But that’s a bad idea for several reasons—not only will you get hit with outrageous early withdrawal penalties and have to pay taxes on anything you take out, but you’re also stealing from your future self! And 401(k) loans are even worse!

The only time you should even consider taking money out of your retirement accounts early is to avoid a bankruptcy or foreclosure. Otherwise, hands off the 401(k)!

Credit Repair and Debt Elimination Scams

In a world that revolves around the almighty FICO score, it’s easy to come across companies that are ready to “fix” your credit report—for a fee, of course. But the truth is, most of these repair companies are scams. They offer to remove the negative information from your report, even if it’s accurate. (Psst. That’s illegal.)

And debt elimination scams are similar. They offer to eliminate or drastically lower your debt for a large up-front cost. But all you’re paying for is falsified loan documents that aren’t tricking anybody. Yikes.

You’ve got the game plan. Now, it’s time to kick your debt payoff into high gear! Use these tips to boost your debt snowball payments and speed up your journey to becoming debt-free:

Getting out of debt won’t be easy, but it doesn’t have to be miserable. Here are seven ways to stay motivated as you pay off your debt:

Weighed down by credit card debt? Find out the best way to ditch that debt for good!

Here’s how to chip away at medical debt, one unwanted hospital bill at a time.

Money’s tight right now. We're all feeling it. But listen, you can get rid of debt, no matter your income. These seven steps will help.

Every day on The Ramsey Show, we invite people just like you to share their financial journey and do a Debt-Free Scream. And yes, it’s exactly what it sounds like! After all the hard work, sacrifice and determination, you get to stand up and proudly shout, “I’M DEBT-FREE!”

Once you’ve officially kicked debt to the curb, you can call in or come to our headquarters in Franklin, Tennessee, to do your Debt-Free Scream live on The Ramsey Show!